De Beers February sight estimated at $550M

The most recent De Beers sight closed with an estimated value of $550 million as the company adjusted assortments to reflect higher values in its boxes.

Sign-up for La Lettre from R&M to get the essentials of current affairs in the diamond industry and privileged access to the articles published below

We keep your data private and only share it with third parties that make this service possible. Read our Confidentiality Policy for more information.

The most recent De Beers sight closed with an estimated value of $550 million as the company adjusted assortments to reflect higher values in its boxes.

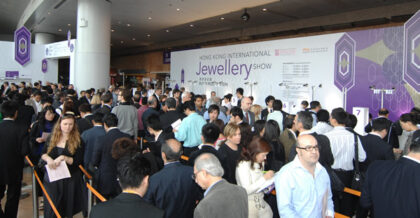

As far as trade shows go, there are only a select few, among the many on the diamond and jewelry industry calendar, that tend to set the tone for the market.

Is there any merit to criticism that the Indian diamond industry is using bank financing for “narrow and destructive interest of speculating on [sic] rough prices,” as the new president of IDMA (the International Diamond Manufacturers Association) recently claimed?

The decision by the Chinese authorities to clamp down on advertising luxury products is a red flag for the diamond industry. While China represents the primary growth opportunity for the trade, the government’s restrictions are presenting hurdles even if its intentions may be pure.

The diamond theft at Brussels’ Zaventem Airport is more a cautionary tale than a story of financial harm.

Among the many significant developments that evolved in the diamond industry in 2012 was a growing awareness about price differences between tinted and non-tinted polished stones. Diamond dealers have come to recognize stones with a greenish-brownish tint as having originated from Zimbabwe’s Marange mines.

Hardly anything trumps bad news, especially if it’s full of blood and gore. Everyone rubbernecks to see the damage when passing a car accident. Serious twisted wreckage makes us slow down even more to get a longer look at the disaster.

The recent proposals made by the Gem and Jewellery Export Promotion Council (GJEPC) for the 2013-2014 Union Budget are a step in the right direction but are not far-reaching enough.

The recent improvement in both rough diamond trading and prices in the secondary market should raise some eyebrows. While it has helped inject additional confidence into the market, it remains unclear whether this momentum will be sustained.

Prices stable as premiums improve De Beers January sight had an estimated value of $550 million as the company continued to limit supply. Prices were basically stable with slight changes made to assortments.

This is not the column I’d prepared for today. That one was written, proofed, readied, and even had a visual prepared to illustrate a point – and then I abandoned it.

Harry Winston Diamond Corp’s sale of its luxury brand to Swatch Group is the most significant step yet taken by this rapidly evolving company. Essentially, the deal marks the end of Harry Winston the mining company, as the brand returns to its luxury roots, and the mining business is renamed Dominion Diamond Corporation.