AWDC and Bain & Company noted in their 2016 global diamond report that rough-diamond revenues declined by 24 percent in 2015 as the midstream segment sold down accumulated inventories.

The report noted that manufacturers reacted to softening demand by reducing production, increasing inventories and cutting rough-diamond prices.

Rough-diamond prices also fell by 15 percent in late 2015 and remained largely static in 2016’s first half.

The diamond industry had suffered the “ripple effect” from the mild decline in consumer demand for diamond jewelry that started in 2014 in Greater China.

The slowdown led to a notable drop in demand for polished and rough diamonds, which in turn led to price decreases for polished and rough diamonds of 12 percent and 23 percent, respectively, since May 2014 and of 8 percent and 15 percent, respectively, since the beginning of 2015.

“The weaker-than-expected growth in customer demand initially affected demand for polished diamonds as retailers built up inventories and reduced purchases of polished diamonds,” AWDC and Bain & Company noted in their 2015 report.

“The slowdown then extended to rough-diamond producers as mid-market companies built up their inventories and reduced their purchases of rough diamonds despite declining prices.”

They also noted then that as in past years, the industry faced key challenges: sustaining long-term demand for diamonds in developed markets and among a new generation of consumers, and boosting demand from other sources than jewelry and aesthetic use.

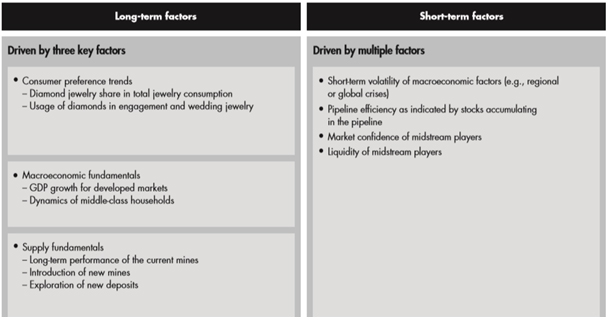

Source: Bain & Company

AWDC and Bain & Company, however, said in their latest report released last December that the diamond industry was on the road to a recovery.

Rough-diamond suppliers posted strong sales in the first half of 2016, mostly due to restocking by cutters and polishers following their inventory sell-off at the end of 2015.

The final results for 2016 and early 2017 would depend largely on manufacturers’ ability to carefully balance inventory levels against year-end demand, the report stated.

“After a decline of about 15 % in late 2015, rough prices remained at the same lower level throughout most of 2016.”

They noted that although both ALROSA and De Beers had reduced production, global year-over-year sales for rough diamonds had grown more than 20 percent this year.

“The revenue outlook for full-year 2016 is very positive, based on strong sales by major producers at recent Sights in preparation for the holiday season,” the report read.

ABN Amro also wrote in its latest report that diamond trade had turned the corner.

“Whereas in June, when we last wrote our Diamond Market Outlook, there were still doubts if global diamond trade would improve, recent data paint a far more optimistic picture,” ABN Amro wrote.

“Diamond trade data have clearly improved in all centres most noticeably in Antwerp, Israel and India. This in line with the general improvement in global trade we have experienced also filtering through to a niche market like diamonds. Only a modest slowing of the Chinese economy and the effects of the Chinese anti-corruption campaign on jewellery demand are fading out.”

The ABN report further noted that not only had Antwerp diamond exports to China improved and Hong Kong stabilised, exports to the US were also bottoming out.

“Trade data from the two other main trading centres, UAE and Israel also show an improvement in diamond trade in both polished and rough diamonds,” it noted.

“This signals that diamond trade has turned the corner and we expect a further improvement in 2017.”

De Beers’ sales volume leaped 29.2 percent through the end of June.

The group had also recorded a 160 percent increase in diamond value sold in July to $520 million from $200 million, a year earlier.

However, there was a decline in the latest rough diamond sales as announced by De Beers and Alrosa.

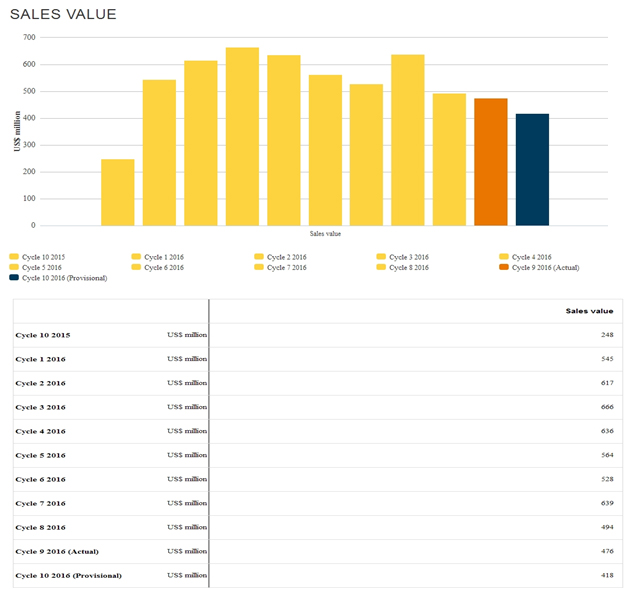

De Beers earned $418 million from its tenth rough diamond sales cycle compared with the revised $476 million value of the ninth sales cycle of 2016.

Source: De Beers

The latest rough diamond sales were the lowest this year with the April sales of $666 million being the highest as shown above.

De Beers chief executive Bruce Cleaver said the company “continued to see good demand” for its rough diamonds.

The tenth sales were, however, higher compared to $248 million raked in, a year earlier.

“While the trade in lower value rough diamonds is experiencing a temporary slowdown as a result of the demonetisation programme in India, demand across the rest of the product mix continued to be healthy and overall sales remained in line with seasonal expectations,” said Cleaver.

De Beers’ competitor, Alrosa of Russia, reported rough diamond sales of $245.6 million for November compared to $430.8 million in October.

[two_third]

“The market activity at year-end was affected by India’s currency reform in November,” said Alrosa vice president Yury Okoemov.

“One of its effects was a temporary decline in the activity of India’s small and middle-size diamond cutting companies, which also affected the low-end small-size rough diamond segment. Activity in other market segments remains high.”

AWDC and Bain & Company noted that the long-term outlook for the diamond market remained positive, with demand expected to outpace supply starting in 2019.

[/two_third]

[one_third_last]

“AWDC and Bain & Company noted that the long-term outlook for the diamond market remained positive, with demand expected to outpace supply starting in 2019.”

[/one_third_last]

“We expect demand for rough diamonds to recover from the recent downturn and return to a long-term growth trajectory of about 3 percent to 4 percent per year on average, relying on strong fundamentals in the US and the continued growth of the middle class in India and China,” they said in the report.

However, developments in India as shown in the outcomes of Alrosa and De Beers last rough diamond sales for the year were indeed a real threat to the gains recorded last year.