In early 2015, the retail market became very aware of lab-grown diamonds (LGDs). It’s not that no one had ever heard of them before, but this suddenly became a major topic. At JCK Las Vegas that year, most retailers voiced opposition to LGDs, basically saying that they didn’t want to be associated with them. However, only a year later, retailers, traders and most others voiced a different tune: “We will go where our customers want us to go.” Consumer market forces indeed set the tone.

A closer look reveals some details that played a role in this shift in attitude towards lab-grown. For example, that retailer margins on LGDs were higher. Traders found that out too. Coupled with growing consumer demand for a lower-priced product promising to be the same (but more ethical, as the erroneous claim goes*), it was not long before the flood gates opened.

Going past early adaptors

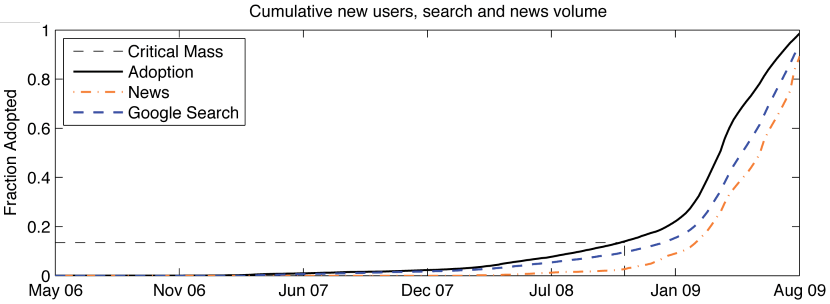

Currently, we are at a classic developing point established by many new products: after a very long period of slow development and very slow rise in use, followed by early adaptors raising demand and awareness, we are now at the stage where a walloping leap occurs as market adoption takes place. This adoption model was true for use of Google search queries, smart phone purchases, and the number of new Twitter users. The following graph shows how this worked for Twitter sourced from Plos One (and a highly recommended read if you want to understand the modeling of these trends).

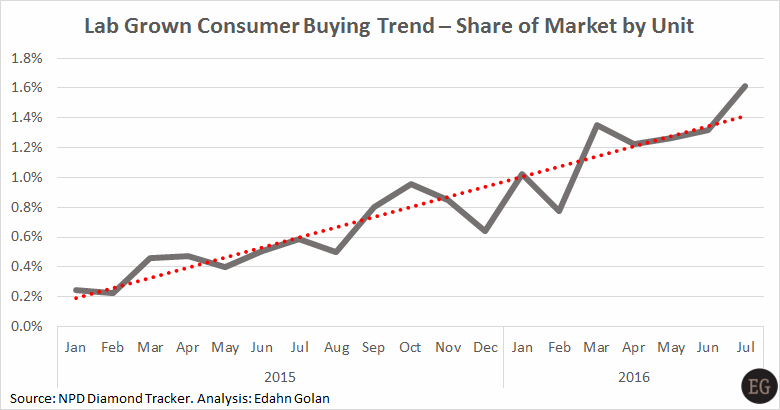

I know that academic articles usually bore people to tears, and I have no intention of losing readership over this, so I’ll just say that this trend is the face of LGDs in the consumer market. Just to prove the point, consider the following graph of LGD sales beginning in 2015. The figures were small at the time, but the early trend was clear: within 18 months, LGD sales as a percent of all diamond sales didn’t just double or quadruple – they increased 8-fold.

The leap in adoption rate is not limited to consumers or retailers. Traders, manufacturers and other diamond industry players are getting into the lab-grown business too.

What happened to prices?

In a bid to protect diamonds from the loss of market share, De Beers launched a new initiative called Lightbox in May 2018. One of the ideas behind this lab-grown jewelry program was that lab-grown diamonds should be priced based on a reasonable margin above their cost of production, and not on some artificial discount to natural diamond pricing.

Lightbox’s $800 per carat pricing was viewed by the industry as something that could possibly drive down LGD prices and, in turn, lower its positioning in the eyes of consumers to a mere imitation/replacement item. So, has Lightbox succeeded so far in forcing a price drop? The answer is mixed.