There is a close connect between advertising and spending, says Aasha Gulrajani Swarup writing for the Diamond World at www.diamondworld.net. Neither a global economic slowdown nor a recession could restrict worldwide spending on personal luxury goods, estimated to touch US $275 billion in 2012, and growing in double digits.

[one_half]

Diverting the flow of this global spend on luxury, into diamonds, would be like a game of Russian roulette, except that the World Federation of Diamond Bourses has a smart plan to bring about the shift. Generic promotion through the World Diamond Mark is the answer, which proposes to unite players in the diamond pipeline. Riding on the failure of the International Diamond Board, the World Diamond Mark is all set to take off in July 2013, with the slogan, When the World Loves, we are here.

In the 1930s, when America was in the midst of the Great Depression, the stock market had crashed, and world diamond prices had plummeted, a company with diamonds to sell, wondered, “when people don’t have bread, will someone buy a diamond?”

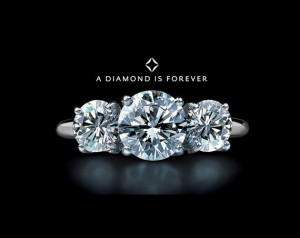

The copywriter at the advertising agency literally prayed for an answer. Her slogan, “A diamond is forever,” went on to become the most successful line in the industry.

Diamonds became the symbol of love and every woman aspired to be gifted a diamond on special occasions. By the time, America came out of the Depression, 80 per cent of weddings in the country were incomplete without a diamond ring. Successful generic advertising also changed the public psyche in Japan as diamonds went on to become an integral part of a traditional Japanese wedding.

Ironically, the woman who coined the phrase never married. For De Beers, the diamond conglomerate behind this generic marketing blitzkrieg, which ran for almost 50 years, it proved a worthy game-changing investment. The romance of the diamond still sustains.

Concedes Andrew Bone, Global Head of Government & Industry Relations for De Beers, “‘A Diamond is Forever’ was acknowledged by many as the most powerful and successful advertising slogan of the 20th Century. There is no doubt that De Beers’ generic campaigns helped to create and maintain the ‘diamond dream’ and was instrumental in opening new markets such as Japan in the 60s and 70s.”

Since De Beers decided to focus more on promoting its own brands, like Forevermark, and withdrew its generic campaign, was it a mere co-incidence that consumer spending on diamonds decreased over time, or is history repeating itself?

History repeats itself?

Seventy years later, the world is going through an economic slowdown. Diamonds are no longer on the priority list, and even growth in the global expenditure on diamonds is marginal, as buyers have become cautious about luxury spending. Diamond players for long have been toying with the idea of getting together to collectively promote diamonds. Perhaps now is the right time to let the drums roll for the second round of the generic promotion for diamonds. When prices of polished diamonds have dropped and for the first time since 2008, prices of diamond roughs are reportedly heading for an annual decline. The idea has finally taken off.

Diamond World spoke to the man executing this idea. Alex Popov, president of the Moscow Diamond Bourse is part of a four-man team tasked to develop the World Diamond Mark program, under which the generic promotion of diamonds is to be launched.

Popov says, “All major luxury items advertise heavily, except diamonds. Lack of clear brand awareness leads to loss of market share. During the last 10 years, while expenditure on luxury products jumped 60 per cent, the expenditure on diamonds increased by only 15 per cent. We want customers to spend on diamonds, which is a luxury product, truly forever, and unlike other high value goods, goes through generations. A diamond is eternal and to keep it so, generic promotion is necessary.”

Agrees Bone. “As competition from other luxury goods and services increases, generic advertising would help to keep the ‘category’ of diamonds in the minds and imagination of the consumer.”

World Diamond Mark program

The World Diamond Mark is the new partnership initiative set up under a non-profit organisation in Hong Kong that will work as the largest accreditation and marketing arm of the diamond industry. The World Diamond Mark was launched in Mumbai in October 2012, by the World Federation of diamond Bourses, the largest diamond organisation, representing 28 affiliated diamond bourses worldwide and membership of 95 per cent of world diamond dealers, and backed by the International Diamond Manufacturers’ Association (IDMA). The entire diamond and jewellery industry was invited to be partners in this global initiative.

Membership & fees

The WDM program is a voluntary membership programme which makes it a win-win situation for all. The WDM already has 4000 members on board, who have either taken membership or it is under process.

There is a one-time joining fee of US $400 and an annual membership fee of US $100 per showcase or shop. If a retailer has a chain of stores, they can negotiate for a better rate.

Upon membership, the retailer is given a special hologram showing him as an authorised diamond dealer. The proceeds shall be used for generic advertising and promotion of diamonds.

Although the WDM welcomes all the stake holders in the diamond industry as partners in this initiative, its expected membership strength of 5000 members in the first year, shall be initially drawn from local retailers only. The first phase is restricted for the diamond organisations, retailers and manufacturers only. “Diamond miners are expected to join after the second phase. We shall be talking to miners, DeBeers, Rio Tinto, Harry Winston, Alrosa. Even the small miners in Zimbabwe, who are not in a position to contribute big amounts, are keen to support this program. We want to be inclusive, not exclusive,” explains Popov.

Within five years, the membership to the WDM program is expected to increase to 60,000 members, drawn from Hong Kong, India, China, Russia, Australia, Middle East, Japan, the USA and lastly Europe.

Authorised diamond dealer sells more

Through membership, the WDM seeks to help the retailer acquire the direct tangible benefits of rise in sales, cash rebates and prestige. To achieve these targeted benefits, there is a three pronged strategy.

Informs Popov, “Membership into the program will raise the profile of the diamond retailers. To become members they sign a code of principles, which emphasises transparency whereby a retailer becomes the Authorised Diamond Dealer. Besides improving brand image, it promised to promote responsible practice and fair trade.”

Each retailer will also be provided with educational tools including online training modules and courses for their sales team to understand the basics of diamonds which will enable them to sell more. Brochures on diamonds shall be provided in various languages.

Generic promotion & strategic partners

“Secondly, the WDM shall undertake generic promotion of diamonds, which will also help the authorised diamond dealer to sell more. Thirdly, to help the dealer get immediate monetary benefits, the WDM program has signed up with strategic partners, including credit card companies, which have agreed to offer the Authorised Diamond Dealer discounts on the commission charges, lower transaction fees and return on sales or rebates at the end of the year.”

The structure of this programme is similar to that of the Platinum Guild International, that undertakes generic advertising for the promotion of platinum. Agrees Popov, “They promote platinum while we shall promote diamonds.”

Platinum Guild International has an integrated marketing communications approach to stimulate consumer demand and to further build newer markets. To address different consumer segments, marketing and product needs, PGI has a strong trade programme with key retailers and chain stores across the country besides conducting generic advertising to promote consumer demand. “Under its trade programme, PGI has provided sales support and retail sales training for 30 years globally and for a decade in India, since its inception. All the authorised platinum retailers stock hallmarked platinum jewellery, which serves as assurance of a buy back program,” informs Vaishalee Banerjee, Country Manager (India) of Platinum Guild International.

Similar to the PGI strategy, WDM is also developing its connect with traders, Informs Popov, “We shall show a list of authorised diamond dealers on our website. By the first quarter of next year, we shall establish the structure; put the infrastructure in place, the CEO who will run the business and the people to take care of the day to day running. We are also looking at an advertising agency to devise the marketing plan, which has a strong presence and affiliation in India, China, Russia, Middle East and USA.”

Marketing plan

The programme is all set to take off with its first pilot campaign to be launched in July 2013, initially in two countries. The initiative will be launched with the slogan, ‘When the World Loves, we are here’. There would be an umbrella campaign which shall be adapted for each country. “The annual marketing spend on the generic promotion and advertising of diamonds is expected to be more than US $100 million by the fifth year.”

Depending on the source of the collections, the money will be ploughed back into the country where it originates to fund the marketing plan. The aim of generic promotion is to raise awareness and target consumers. We do not know yet which country we shall launch first. It would be an emerging market. It could be Hong Kong, China or India or even the Middle East, informs Popov.

Necessity of generic advertising

Players in the diamond industry agree that a generic promotion of diamonds is necessary. The first round was funded almost entirely by De Beers, that had a huge ad budget running into hundreds of millions of dollars annually and a marketing plan to inject glamour into the diamonds they mined and sold. In the late 80s and early 90s the marketing spend by De Beers was around $200 m per year.

The strategy included appearances by movie stars and celebrities heavily adorned with diamonds, product placement in films, public shows with jewellers giving talks and lectures to thousands of young women besides advertising in newspapers, magazines, television and radio. According to writer Edward Jay Epstein, directors and screenwriters were persuaded to insert scenes into films that captured the romance of diamonds. Who can forget Marilyn Monroe singing “Diamonds are a girl’s best friend.”

[/one_half]

[one_half_last]

Jewellers were encouraged to distribute diamonds to top Hollywood stars for public appearances. The message was clear. Diamonds are a necessary luxury. The campaign ran for 50 years, until fortunes changed and De Beers lost market share with the diamond industry becoming more chaotic. Although De Beers then focussed on its own brands, it had successfully created and sustained a connection between something with no intrinsic value and love, the most powerful human sentiment. As marketing spend on generic diamond promotion plummeted, the market weakened and players once again saw the need for such advertising for sustainability.

Says Russel Mehta, Managing Director, Rosy Blue (India), “Yes, generic advertising of diamonds is definitely needed. Without reminding the consumers the ’emotional reasons’ to buy diamonds, the message over time will be lost and we cannot say with certainty that in the next 10-20 years, men will still be proposing to their brides with a diamond ring! The message needs to be repeated over and over and over…”

French fashion house Louis Vuitton is entering into television advertising for the very first time with its commercial that is part of a multichannel brand awareness campaign. The fashion czar Louis Vuitton is geared to broadening the reach of its new campaign by using multiple marketing channels, but through television and social media it could reach more aspirational consumers than affluent prospects.

Louis Vuitton’s current strategy seems to be to reach as many people as possible in as many ways possible, whether it be through marketing efforts or rapidly expanding distribution channels. Creating hype for a campaign is a must for marketers across all categories, since marketing budgets must be maximised, seems to be the mantra even for the largest fashion house on the global map.

A recent survey of Digital Marketing and Content Survey reports that overall, 83 per cent of travel companies indicate that they will increase their digital content budgets in 2012, up from 70 per cent in 2010 and 66 per cent in 2009.

International Diamond Board

This was the reason the industry bigwigs came together in 2009 to develop a pan-industry body called the International Diamond Board. It was an initiative of the major diamond mining companies to develop a generic marketing strategy ?for the industry. But it never took off and became defunct.

Looking back, Bone recalls that “IDB was created to develop generic advertising campaigns on behalf of the industry, from mining to retail. Unfortunately, it didn’t quite get the full support it needed and the project was shelved.”

There was a clear lack of unity among the ‘founding fathers’. No leader could be accepted by everyone, who had no vested interests. Most wanted to be free riders without participating in the funding.

As Popov puts it, “IDB was meant to be generic advertising for the sake of an ‘elite’ club who eventually could not agree who’s more important. The idea was excellent, but based on the wrong premise. World Diamond Mark is different, being grass-root up, not elite down.”

All set to take off, four men have been instrumental in moving the World Diamond Mark from concept to creation. Rami Baron, president of the Sydney diamond Bourse who first spoke of a retailer mark, Suresh Hathiramani, president of the Singapore Diamond Bourse, who institutionalised the project, Alex Popov, who established the structure and secured support besides various professional advisors and consultants including Nicholas Chretien of Bank of Changes, who put the concept together and K.K. Yeoung in Hong Kong who devised the corporate structure of World Diamond Mark Foundation.

Finally after thousands of pages of correspondence and hundreds of hours of meetings and conference calls across five continents, the industry is eagerly awaiting the World Diamond Mark.

Clearly, there is support across the industry for such a concept. Generic marketing, if successfully executed, will benefit the category as a whole, raising and maintaining consumer interest. “As they say, a rising tide floats all boats,” says Bone.

Funding V/s free riding

The basic rule of generic advertising is co-opetition – first co-operation and then competition. Its primary problem has always been funding by a few with free loaders enjoying the benefits too. The organisational structure of the World Diamond Mark over rides this primary problem of funding for generic promotion.

Historically, generic advertising has been undertaken as a group, by a collective and was popular for non-luxury products, like milk and yogurt, computers, high definition TV and DVD, apples, eggs, meat and family planning, commodities like tea, butter and cotton, even bank services like life insurance and importance of regular eye check ups. An example, and perhaps the only one in the history of generic advertising, essentially backed by a single conglomerate, was of course the iconic promotion of diamonds by De Beers. Generic advertising proved successful for all these commodities.

Efficacy of generic advertising

A study found that the generic promotion of apples by the Washington Apple commission from 1937 until 2003 had successfully impacted demand, and increased growers’ total revenue by US $53.4 million for 2002. The estimated average return to advertising topped US $8.7 per dollar of advertising.

Successful generic campaigns are usually spread over a long term, use a medley of media, innovative themes, and even celebrity endorsements. Individual retailers, without the huge resources required to make such a commitment, focus on brand promotion.

Therefore, traditionally, generic advertising is usually backed by industry organisations, which promote the whole category, like the Platinum Guild International or the World Gold Council. The benefits are tangible.

For instance, through systematic generic advertising on television, print and billboard, the Platinum Guild International worked to make platinum popular among consumers. It launched its Platinum Day of Love campaign, which was leveraged on social networks like Facebook. Platinum’s strength, durability, unchanging colour and resistance to tarnish, were marketed symbolically as the emotional connect between couples besides providing an ideal and secure setting for diamonds and other gemstones.

“These marketing efforts have been successful in developing the gift of love market for platinum across India. Platinum is well entrenched in the minds of the consumers in the age group of 25 to 35,” said Banerjee/ The strategy worked. Quantitatively, there are more retailers of platinum jewellery today and also more customers with a large part of a retailers business coming from new customers.

Generic advertising v/s brand positioning

Advertising gurus aver that generic advertising helps to increase primary demand by attracting new consumers, increases per capita consumption and lengthens the life cycle of the product. Hence generic advertising, which benefits all the players, is particularly effective in the introductory stage to bring about product acceptance, or even to promote mature products, while specific brand advertising works in the later stages. But industry players agree that both are necessary, generic promotion to increase sales demand and brand advertising to capture market share.

Says Russel Mehta, “I think you have to do a bit of both. The generic promotion of diamonds will ‘enhance’ the impact of individual brands. Generic advertisements will therefore form the bedrock for all the advertisements the individual brands will do.”

The luxury pie

This makes sense, considering that the world economic slowdown has barely dented the market for luxury goods. According to the 2012 Luxury Goods Worldwide Market Study by Bain and Company, released in October 2012, no slowdown is expected as the global luxury goods sector has continued to soar to post-crisis heights in 2012, with its third year of double-digit growth. Bain further expects an average of seven to nine per cent annual increases in global sales to fuel luxury brands’ growth aspirations until the middle of the decade. Globally, luxury goods sales are expected to reach an estimated US$ 275 billion, with 10 per cent growth versus 2011.

Bain also found that market growth was tilting to the absolute end of the luxury spectrum, with the true highest-end brands and products outperforming more accessible offerings, by two to four per cent a year. Among luxury categories, accessories and hard luxury, including watches and jewels, still outperformed the market, while jewellery was boosted by new brands entering the battleground. Watches were the first luxury category to penetrate emerging markets, which are expected to see 30 per cent of global luxury sales. Consumers’ insatiable chase for higher quality and greater craftsmanship favoured absolute luxury offerings.

Therefore, Claudia D’Arpizio, a Bain partner and lead author of the study, recommended that “to make a dent in the luxury market, brands had to develop strategies with much wider reach than ever before.”

Promotion & positioning

Realising that marketing promotion and brand positioning are the keys to stay on top, Tagheuer, among luxury watch brands, created its niche around sports, especially car racing. In India, it even collaborated with the construction company, which built the 5.4 kilometres long Buddh International Circuit, the prestigious Formula One racing track.

In USA, it became a partner of Oracle Racing. This luxury brand also used movie stars and sports celebrities and spends around 25 per cent of its annual marketing budget on television advertising. The revenues and profits from its watches and jewellery division doubled in 2011. Its number of stores also increased from 122 in 2010 to 327 in 2011, which includes 170 additional stores from the integration of Bulgari.

This aspirational brand has never engaged in generic advertising, which has little effect on individual market share, largely determined by product, price and effective brand advertising.

Riding on the back of the generic advertising wave to be launched next year, major diamond companies are preparing to invest in marketing their brands to influence consumer choices in jewellery, which shall only add to the reinforcement of diamonds as a category and bring about brand distinction among the clutter.

The outcome of this movement is positive. It means diamond players are coming out of denial and acknowledging the weakness in the diamond market. They have realised that the diamond market is ultimately demand, and not supply, driven. They have also come together and are united to keep the diamond dream alive. The real test would be the impact of the promotion on the market share of diamonds in the luxury pie. That is the bottom line.

[/one_half_last]