The diamond industry will remain under pressure as geopolitics and the rising popularity of lab-grown cause a fundamental restructuring of the market, cautioned Rapaport Group Chairman Martin Rapaport.

“We’re in for a bit of a bumpy ride over the next year or so,” Rapaport said in a webinar last week. “There will be unprecedented change as the real-diamond business repositions itself in the face of stiff competition from synthetics.”

The diamond industry has seen significant drops in 2023. The RapNet Diamond Index (RAPI™) for 1-carat polished diamonds fell 20% from the beginning of the year to October 2, after the rate of decline accelerated in recent months.

It’s very scary, and people should tread cautiously, Rapaport warned. He expressed uncertainty over whether the trend would continue into the fourth quarter, especially as manufacturers were curbing their rough intake. The trade in India last week announced a voluntary ban on rough imports for the next two months.

So far this year, De Beers’ rough sales have slumped 28%, and with three sights left, they to reach around $4 billion for the full year, compared to $5.7 billion last year, Rapaport forecast.

America matters

Rapaport outlined three factors contributing to the market’s slowdown. In addition to the threat of synthetics, economic weakness is fueling uncertainty, with higher interest rates and inflation taking its toll on consumer spending. Changes in the geopolitical landscape are also influencing a major shift in the market dynamic, Rapaport explained.

“We’re coming from a situation where everyone loved each other, but globalization is over,” he warned. “Sanctions are a real problem. Global economic warfare will intensify in the medium to long term, and that will affect the diamond market.”

Sanctions will proliferate, not only against Russia: One also must consider relations with China, and there will also be sanctions imposed on the US, affecting the dollar, he said. With these changes unfolding, the outlook for China is uncertain, but the real money will remain in the US, Rapaport predicted.

Diamond-jewelry sales in the US grew 2% to $47.7 billion in 2022, while the sector’s global turnover was flat at $86.5 billion, according to the De Beers Diamond Insight Report published this week. Sales in China fell 11.2% to $.8.8 billion during the year, De Beers estimated.

With a market share of 55%, America must take a leadership role, even during a period of greater uncertainty, Rapaport asserted.

Higher interest rates and inflation are squeezing disposable income, but that’s not the real reason things are changing, he stressed. “Those economic factors are creating strategic confusion and noise, but how governments are sanctioning each other, and the advent of synthetics, is a big change.”

A retail crime

Lab-grown has risen in popularity in recent years, representing an increasing share of retail jewelers’ diamond sales.

Synthetics account for a mid-teen percentage of the diamond mix at Signet Jewelers, the largest specialty jeweler in the US, CEO Gina Drosos reported in a recent earnings conference call. Lab-grown made up half of loose diamonds and about 6.5% of set diamond jewelry sold by specialty jewelers in the US during July, according to Edahn Golan, cofounder of Tenoris, a trend analytics company.

Consumers with a budget in mind are trading up to increased size or quality lab-grown diamonds, presenting the jeweler with a higher margin and transaction value than natural diamonds on average, Drosos explained.

Consequently, the real-diamond market is going to be reduced or eliminated in certain areas due to synthetics, Rapaport projected.

The biggest gain for synthetics over the past year has been in the bridal and engagement market. However, Rapaport predicted that lab-grown would lose the bridal segment as their value continues to decline. Rather, he anticipated that synthetics would take over the big fashion-jewelry business.

For now, though, bridal is under attack by synthetics, which may have a lasting effect on consumer attitudes, Rapaport noted. By pushing the product, jewelers are convincing millennials and Gen-Z consumers to spend less on engagement rings — and that real diamonds are not important, he cautioned.

“That’s a crime. What business does that?” he stressed. “We’ll see a backlash, because women want to get married and the whole exclusive relationship scenario talks to natural diamonds. If a customer feels it is worth paying more, and give something meaningful, the best they can do is buy the real thing.”

Can’t live off synthetics

Rapaport acknowledged that the price differential is currently working in favor of synthetics.

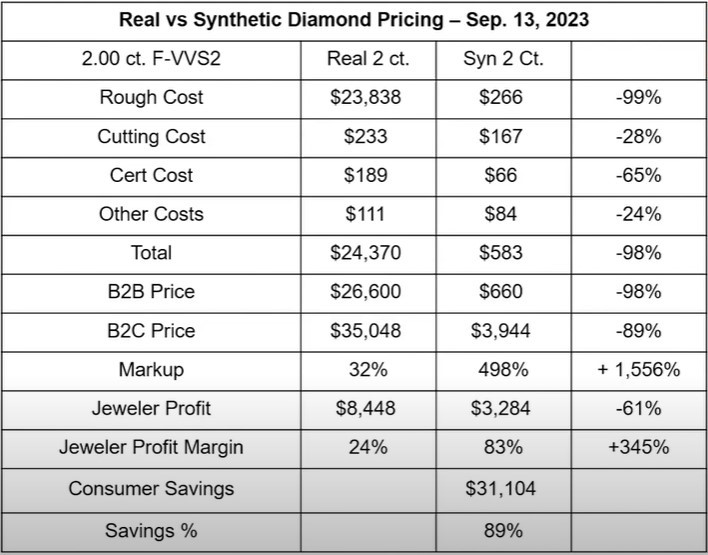

He compared the cost and selling price of a 2-carat, F-color, VVS2-clarity natural diamond with the equivalent synthetic stone at various stages of the distribution chain (see table). The profit margin earned by jewelers was 24% for the natural diamond versus 83% for the synthetic stone. Furthermore, the difference in retail price represented a saving to the consumer of $31,104, Rapaport’s research showed.

“From the jeweler’s perspective, they’re making money and the consumer is saving, so you can understand why everyone is running toward synthetics,” Rapaport said. “But as prices come down so will these numbers.”

Synthetic prices will be so cheap that the net revenue, even at higher profit margins, will be insufficient for a jeweler’s survival, he projected, adding that, “jewelers can’t live off synthetics.”

Rapaport called out those jewelers selling synthetics based on price and questioned their ethics if they did not disclose the expected drop in value to the consumer.

“They’re saying it’s exactly the same product [as natural diamonds], and the Federal Trade Commission [FTC] believes it’s a good product,” Rapaport said. “I believe it’s good with the proper disclose.”

Rapaport is preparing a petition that will ask the FTC to require jewelers to disclose the expected decline in value when selling synthetics.

Diamonds are special

As lab-grown pivots from bridal to fashion jewelry, Rapaport expects the positioning of real diamonds as a luxury product will significantly strengthen in the long term.

He called on De Beers to raise its spending on marketing natural diamonds if it wanted to keep the product [relevant] — even beyond the $20 million the company recently committed to promote natural diamonds over the holiday season.

The test for the industry will be its hold on the fine-jewelry market, with the luxury segment up for grabs, he stressed. It can defend itself with some good marketing, but the trade can’t rely only on marketing; jewelers must sell diamonds properly, and they must stop selling based on price, Rapaport emphasized.

“Real diamonds will be fine, but we have to learn to sell the specialness of diamonds. If your customer is only interested in price, they are not worthy of real diamonds — send them to Swarovski,” he said. “Don’t be afraid to sell expensive goods and realize that diamonds are not for everyone. You are special and your diamonds are special. Never forget that.”

Main image: A lab-grown rough diamond. (Shutterstock)