Various factors drive rough diamond buying. An obvious one is expectations of polished diamond sales.

Naturally, if November-December is the hot season for 1-carat and larger goods, a manufacturer will want to make sure he has enough goods ready to go by early November. And if the diamond polisher specializes in smaller goods, which need to be set in jewelry by jewelry manufacturers prior to delivery to retailers, then the lead-time is even longer.

By this logic, if the manufacturing cycle is about three months and polished needs to be ready for November, then more rough is needed in August.

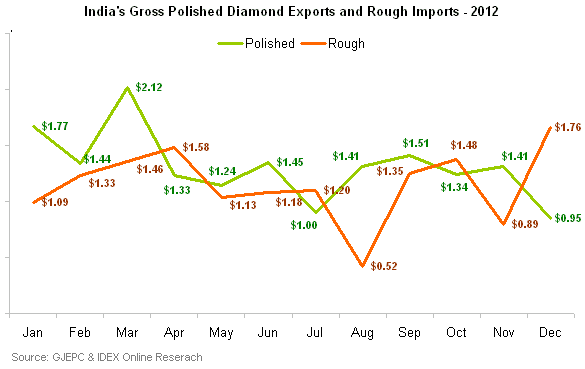

However, when comparing rough imports into a major diamond-manufacturing center, and exports of polished out of it, a different image emerges as the following graph shows (the figures are for rough imports and polished exports to/from India in 2012).

Obviously, there are a few driving influences when it comes to buying rough. A manufacturer wants to make sure his stocks are not too low, for example, or he may have an opportunity to buy goods at a lower price at certain times. In addition, manufacturers in India want to make sure their polishing facilities work at or near capacity as much as possible to retain skilled workers and maintain working margins, and may buy rough just to keep the business optimized.

All of these factors influence the purchasing cycle, but none have had as much effect as actual, recent polished business. As the graph above shows, an increase in polished diamond exports is followed by an increase in rough diamond imports the following month. Conversely, a decline in polished exports is followed by a decline in rough diamond imports.

This is what happened in March and April (an increase follows an increase), in April and May (a decrease follows a decrease), and so on throughout the year.

This is not a trend unique to 2012. In 2011, as polished sold exceptionally well in the second quarter of the year, demand for rough soared. At the other end of the scale, polished declined sharply in August, and demand for rough fell in September.

The trend is continuing. Demand for better quality goods was high in the first two weeks of January this year, leading to shortages in many items. Today, in late January, demand for rough is rising, and manufacturers are once again willing to pay high premiums for DTC boxes, something that has not happened for many months

Producers who are aware of these trends respond to them. They follow demand, and the prices of polished, and calculate backwards to the price of rough. The question to be asked is how manufacturers can protect, or at least hedge, to ensure they buy rough before the rush, and at lower prices, and in so doing protect their margins?