Angola is looking for investors in its diamond industry. In so doing, the country is marketing itself as a conflict-free and friendly environment and is vying to be the Kimberley Process (KP) chairman in 2015 to validate its claim. At the same time, Angola continues to fend off concerns about its current human rights record.

Celebrating 100 years of diamond mining at the Angolan Diamond Centenary Conference in Luanda last week, the numerous members of government speaking were therefore consistent in their point. The Angolan government wants the diamond sector to bring added value to mining and contribute to the diversification of its economy and sustainable development. Angola is also talking up its diamond mining potential of significant unexplored resources there for the taking.

As a result, Manuel Domingos Vicente, vice president of Angola, stressed that developing the diamond industry is a priority for the country during the next decade. The government has devised a strategic geological plan to develop the minerals sector through 2025 and it wants to do so within the legitimate diamond industry framework.

But while the conference warmed the international industry to Angola and its government, it failed to answer some pertinent questions about Angola’s trade.

Still considered a bit of an unknown dark-horse in the industry, many who came to the conference came to learn. They wanted to know how the state-run ENDIAMA mining company sells its goods through its Sodiam subsidiary. Who buys, how and when?

According to the country’s 2011 annual report to the KP, about 47 percent of its rough exports by value went to Dubai, 22 percent to Israel, 19 percent to Switzerland, and approximately 4 percent to the European Community, which includes Belgium, with the remainder sent to other countries. Dubai appears to be strengthening its foothold in Angola and the Dubai Diamond Exchange (DDE) was a major sponsor of the centenary conference.

More significantly, there were no representatives from civil society on the agenda and delegates were left to take the government’s word that the diamond sector is operating in an efficient and ethical manner.

It’s a tough argument to make, given its war-ridden past that is marred with a history of conflict diamonds. In fact, it was Angola’s civil war in the nineties, during which UNITA rebels gained control of the alluvial diamond areas along the Kwango River, which led to the first diamond embargo and the introduction of the certificate of origin for rough diamonds in 1998.

While these certificates were not foolproof in preventing Angolan conflict diamonds from entering the trade, Mark Van Bockstael, chair of the KP’s working group of diamond experts, notes, “They were the grandfather of all certificates of origin used today,” and provided a basis for the formation of the KP a few years later.

With the conflict having ended in 2002, the country has indeed come a long way. And regardless of what was lacking at the conference, the two-day event did reveal some important developments that have taken effect in Angola.

Angola’s new mining code was passed into law in 2011 which aims to modernize and simplify the rules overseeing exploration and mine development in the country. The law is viewed as being far more investor-friendly than before.

Diamonds are highly important to Angola’s economy being its second largest export commodity after oil. Then again, diamonds only account for 2 percent of total exports with oil responsible for 97 percent.

It’s little wonder then that the country is seeking to diversify its economy and is looking toward the diamond industry to achieve that goal. Drawing on the experiences of its southern neighbors, Botswana and Namibia, Vicente announced the country’s intention to develop a diamond polishing and jewelry manufacturing sector. But little was said at the conference to expound upon those plans and it remains unclear what opportunities exist for that sector in Angola.

Greater focus was placed on its mining potential. Both De Beers and ALROSA are active in exploring for diamonds in Angola and it was left to them to expand on the country’s untapped potential.

Charles Skinner, head of group exploration at De Beers, estimated that 90 percent of the prospective area in Angola remains unexplored. Fyodor Andreev, chief executive officer of ALROSA, told the conference the probability of new findings is high given that the geology of the Lunda-North region is similar to that of the Russian territory of Nakyn, where covered kimberlite pipes were discovered in the past 10 to 15 years. ALROSA formalized its intentions by forging a joint venture with ENDIAMA for exploration in Angola at the conference.

Today, around 86 percent of Angola’s production comes from the Catoca mine, which is owned 32.8 percent by ENDIAMA, 32.8 percent by ALROSA, 16.4 percent by Brazilian company Odebrecht and 18 percent by Chinese company LLI Holding. Catoca’s production in 2012 fell 1 percent to 6.7 million carats, while sales declined 5 percent to $579.4 million and profit dropped 7 percent to $131.7 million influenced by weak global demand.

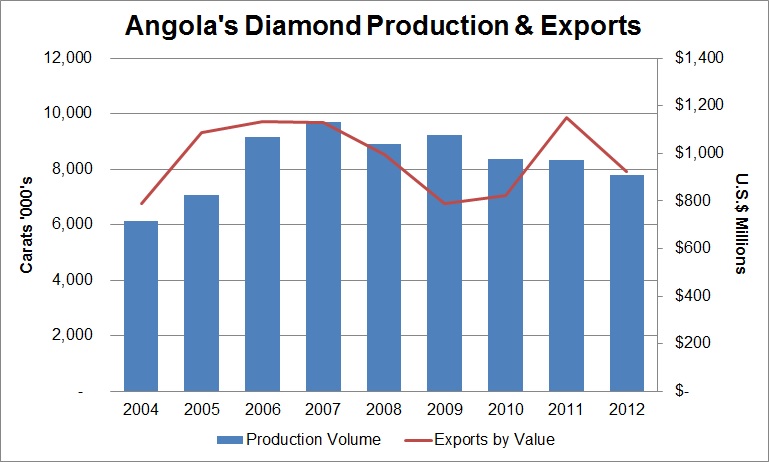

Graph based on Kimberley Process data for 2004-2011 with 2012 based on reported Catoca data.

According to Catoca’s recently published 2012 annual report, Sodiam estimated that the market value for rough diamonds in Angola reached $922.9 million from a total of 7.8 million carats during the year. Other operating mines in the country include a mix of smaller kimberlite pipes and alluvial mining conducted along the Kwango River near the border with the Democratic Republic of the Congo (DRC). It is there that much of the informal artisanal mining takes place, presenting Angola with its greatest diamond-related challenge.

The country continues to ward off claims of human rights abuses associated with its efforts to formalize the sector and prevent scores of migrants entering the country from the DRC to mine its diamonds and smuggle them back across the border.

Following a visit to the country, Navi Pillay, the UN high commissioner for human rights, in April noted significant progress since the conflict ended in 2002 but expressed deep concern about human rights issues associated with the informal diamond mining sector, as well as other segments in Angola.

Pillay reported that one of the major issues discussed at length during her visit was the persistent allegations of abuse – and especially sexual abuse – committed by members of the security forces and border officials.

“I fully accept that the irregular entry of tens of thousands of migrants into Angola every year, many of them seeking to dig illegally for diamonds, is causing major problems for the government which has a right to set limits to migration and to regulate a key industry,” Pillay wrote. “It also has a right to deport irregular migrants, but must do so humanely and in full compliance with international human rights laws and standards…. During my visit to a remote border crossing in Lunda Norte, I received indications that sexual abuse of female migrants is continuing, as well as theft of property.”

While these are allegedly perpetrated by Angolan armed forces and private security companies, and not rebel groups, the KP is unable to respond to human rights abuses under its current mandate and definition of conflict diamonds.

Regardless, the centennial conference did not address these issues. If anything, NGO’s were attacked for exaggerating reports of abuse. While it can be argued that this was neither the time nor the place for such debate, Angola needs to at least recognize that the problem exists within the industry framework.

Diamond industry journalist Rob Bates noted that the government used select positive quotes from Pillay’s report to refute recent accusations about human rights abuses. That is true. But Pillay had noted significant progress that has been made while addressing her concerns in her report. She noted that Angola has a new constitution, which is strong on human rights, and a redesigned Constitutional Court to ensure it is observed. Significantly, Pillay concluded that the government is genuinely committed to improving human rights.

Therefore, credit must be given for the progress that has been made. But the country clearly still has a ways to go and that must be on the minds of those that oppose Angola’s candidacy for KP chair in 2015. Then again, as some point out, being KP chair – for what it’s worth – may influence Angola to further get its own house in order, or it may represent another step in that process.

Angola certainly wants to get the message out to the industry that it aims to play more of a role on the global stage. But while the conference served as a strong public relations effort for the country and indicated significant progress, potential, and good intention on its part, Angola remains on the back foot. Onlookers and investors are still left with questions about its human rights record and levels of transparency after 100 volatile years of the diamond industry there. While there’s no doubt that Angola has a lot to celebrate, hopefully the best is yet to come.