Richemont and LVMH are well positioned to increase their brands’ influence over the industry.

Last year was a big one for luxury jewelry companies. Several brands celebrated milestones, launched new collections and unveiled physical locations, which further elevated their status among high-end consumers.

The luxury houses walk a fine line between the past and present, but they have the financial clout to navigate that challenge effectively.

“Rarely has LVMH invested so much in reinforcing its strengths as it did in 2023,” wrote Bernard Arnault, the group’s chairman and CEO, in its annual report. Those investments led to record earnings, including for LVMH’s jewelry and watch division. Similar sentiment was expressed by Johann Rupert, chairman of Richemont, which produced record revenue.

The luxury jewelry sector has outperformed the market, registering growth through a tough economic environment that has tested the rest of the industry.

Global luxury jewelry sales grew 5% to 6% in 2023, fueled by an investor mindset in the fine-jewelry category, according to the annual Bain-Altagamma “Luxury Goods Worldwide Market Study” that Bain & Company published in January.

“Consumers view fine jewelry as a bright spot for investment amid uncertainty,” the researchers wrote. Demand for bespoke pieces is holding up, while there was growing interest for repetitive high jewelry targeting the ultrarich, they continued. Fashion jewelry continues to accelerate, as do the genderless and male segments, the report added.

While consumers might see lasting value in their purchases, the luxury houses emphasize the quality, design, legacy and story behind that investment-like proposition. And with the big luxury fashion conglomerates now owning many of the leading brands, the likes of Richemont and LVMH are gaining an even greater share of the jewelry market.

Creating Goodwill

The whole is greater than the sum of its parts. For example, Buccellati, Cartier, and Van Cleef & Arpels can extract more value as part of the Richemont group than they might individually as brands. In turn, Richemont seeks companies that can thrive in such an environment, as chairman Rupert noted in the company’s recent annual results.

“We always strive to create goodwill rather than buy goodwill,” he said, observing that Buccellati’s sales had increased four-and-a-half fold since Richemont acquired the Italian brand in 2019.

Now Richemont is looking to achieve the same with Vhernier, another Italian label, which it bought last month for an undisclosed amount.

Vhernier brings something different to the group’s portfolio, with its handcrafted sculptural designs and use of unconventional metals such as titanium, bronze and ebony. Its “unique aesthetic perfectly complements our existing collection of renowned jewelry maisons,” Rupert said in the May 7 announcement.

Major Sellers

These acquisitions have advanced Richemont’s position as the world’s largest seller of jewelry by value.

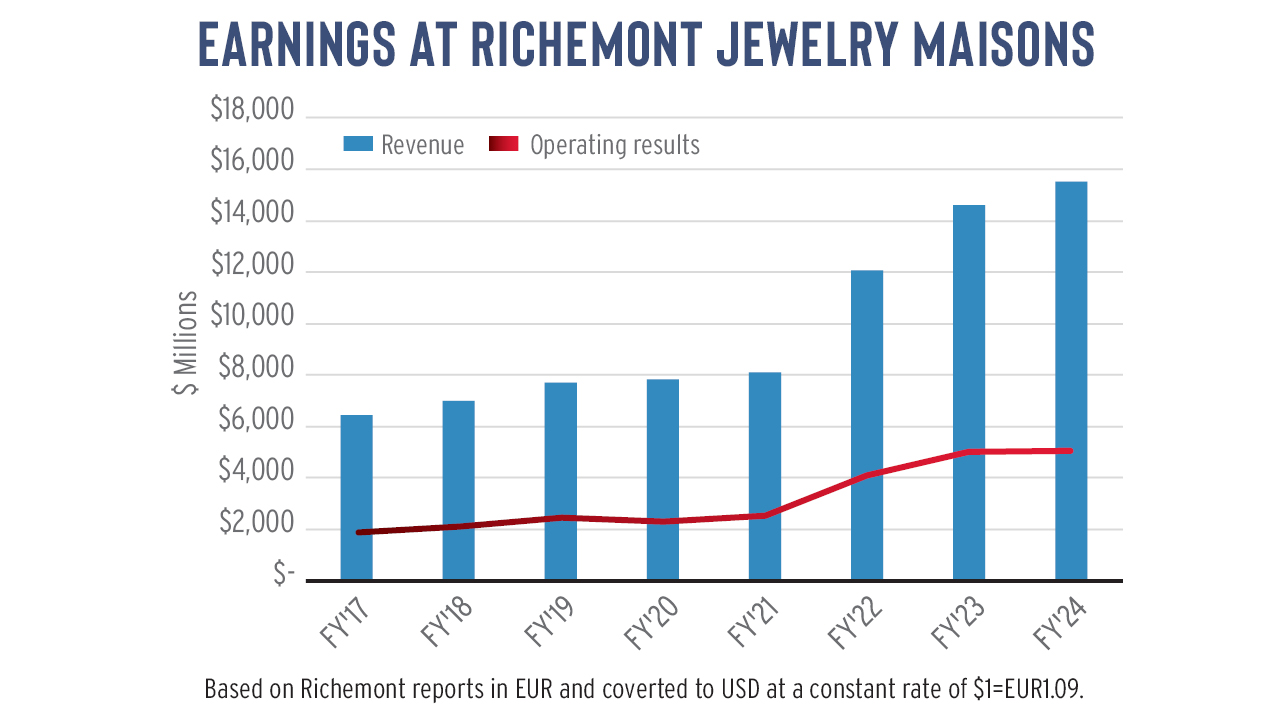

Revenue across its jewelry maisons grew 6% to EUR 14.24 billion ($15.5 billion) in fiscal 2024 that ended March 31 (see graph). While that includes jewelry and watches sold by the brands, revenue from jewelry alone increased 7% to EUR 10.7 billion ($11.6 billion). The group is also highly profitable, as the maisons’ operating result rose 1% to EUR 4.71 billion ($5.12 billion) in the fiscal year, while the division registered an operating margin of 33.1%.

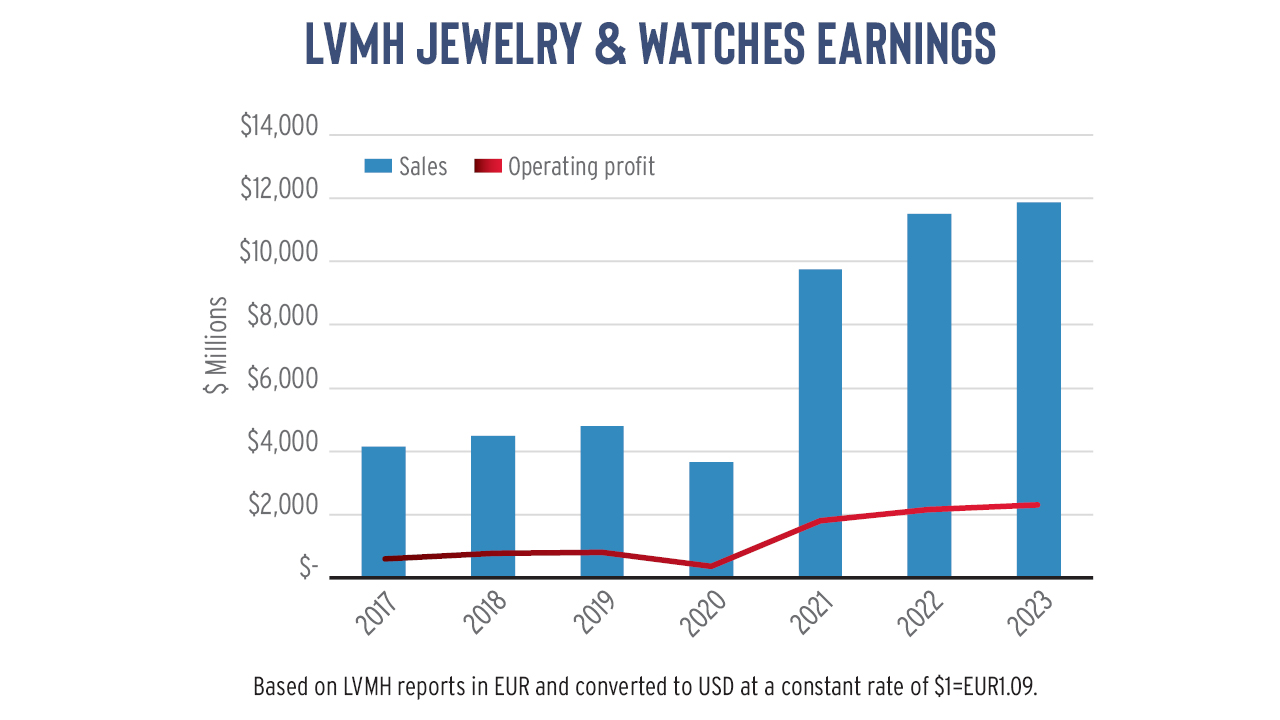

Its closest competitor, LVMH’s watch and jewelry unit, saw sales rise 3% to EUR 10.9 billion ($11.86 billion) in calendar 2023 (see graph). Profits from recurring operations grew 7% to EUR 2.16 billion ($2.35 billion), with an operating margin estimated at 20%.

LVMH also boosted its jewelry presence through an acquisition. It acquired Tiffany & Co. in January 2021, which added about $4 billion worth to annual sales. The rest of the division includes Bulgari, Chaumet, Fred, and Repossi, and watch brands Hublot, TAG Heuer and Zenith.

Evenly Spread

There are synergies from which the brands benefit by being part of these fashion conglomerates. These include infrastructure and financial backing that provide an advantage independent jewelry brands might be lacking and with which they cannot compete.

That said, they also operate in a “thriving branded jewelry” segment of the market, as Rupert describes it, which registered growth across all regions in 2023.

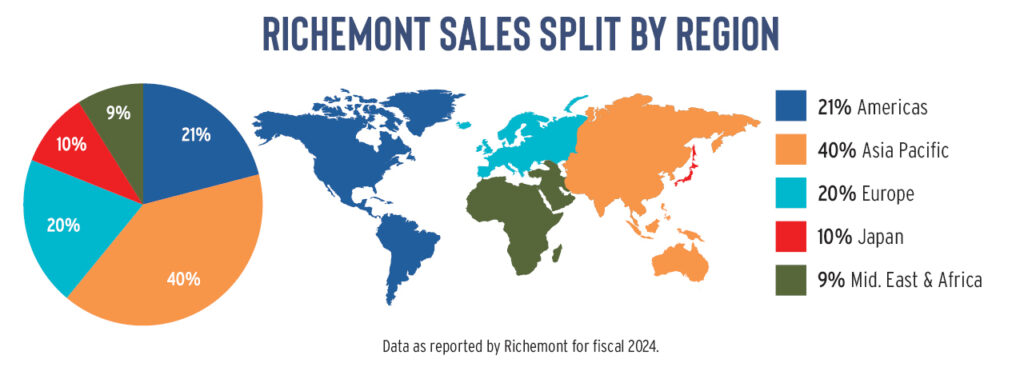

The high end is geographically more evenly spread out than the rest of the market. While the United States constitutes over half of the diamond-jewelry market, according to De Beers research, Asia Pacific is the biggest location for luxury.

The region represents the highest proportion of sales at Richemont and LVMH when measuring total revenue across all product categories. At Richemont’s jewelry maisons, Asia accounted for 40% of sales in fiscal 2024, the Americas 21%, Europe 20%, Japan 10% and the Middle East and Africa the remaining 9% (see graph).

Growth across the luxury sector has been supported by a resurgence of high-end spenders returning to travel after the pandemic, which boosted sales in Europe and within China, according to the RetailX Global Luxury 2024 report.

Embracing Tech

Luxury brands have also benefited from emphasizing their physical locations and blending it with the digital experience they offer. Those that have a strong stand-alone, or “mono-brand,” presence could capitalize on this, the Bain-Altagamma report stressed.

Mono-brand stores and websites — focusing on a single brand — should become the leading channels for luxury purchases, representing an estimated 60% to 66% of luxury market share by 2030, the report predicted. In contrast, “multi-brand” environments suffered from a sharp slowdown in both department and specialty stores, with rising questions on their role and value proposition to best serve consumer needs in the future, the report observed.

That plays into those jewelry brands that, within the framework of their parent groups, and with their backing, can strengthen their own identity and sales channels as mono-brands.

That’s not to ignore the digital space. While luxury is entrenched in physical retail, it is not averse to technology. The high end has increasingly relied on the role of social media and influencers to drive sales and has been among the pioneers of selling in the metaverse, RetailX said in its report.

Luxury companies are also experimenting with artificial intelligence (AI) and generative AI as tools to enhance customer service, simplify repetitive tasks, improve productivity, and create new ideas and content for marketing and product design, researchers at Deloitte wrote in a report titled “Global Powers of Luxury Goods 2023.”

Among the jewelers, the Deloitte report continues, Richemont recently collaborated with Google to use AI to collect and organize customer insights to create tailored marketing strategies, while Tiffany & Co. and Cartier both partnered with Snap to let people try on their products virtually. Luxury companies are also using technology to track their sustainability commitments, which jewelry brands are increasingly emphasizing.

Continued Investments

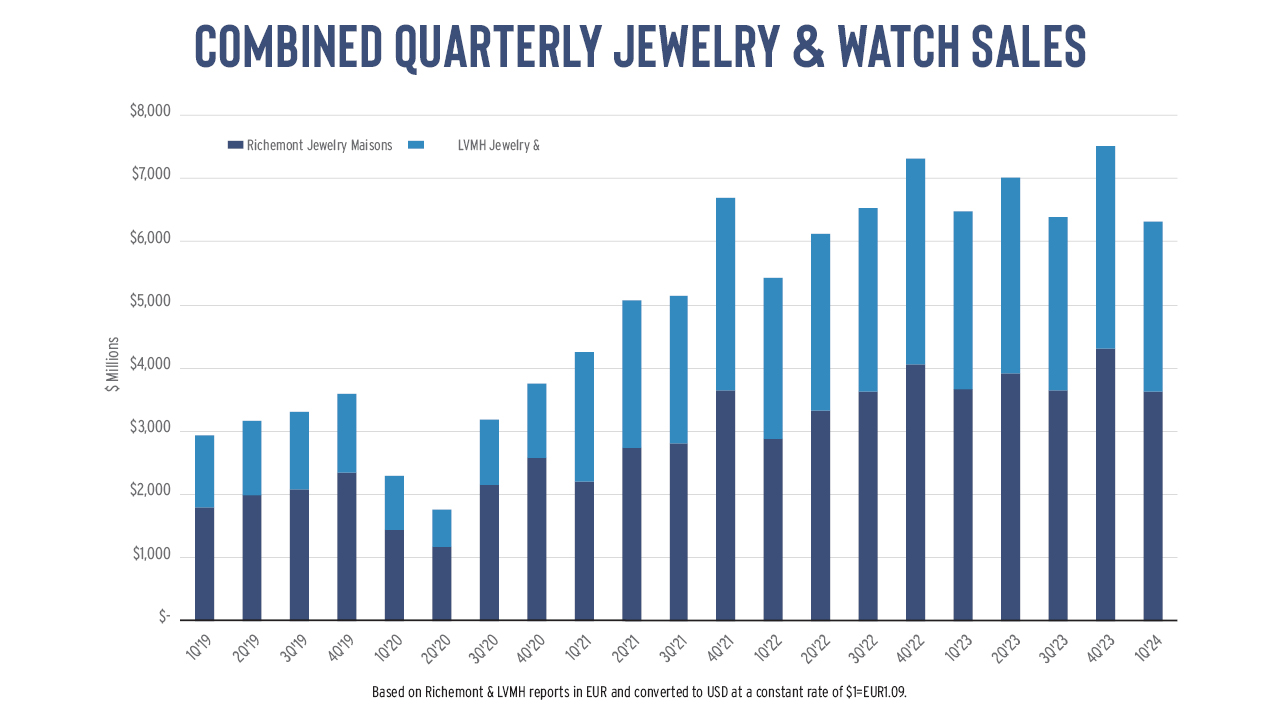

All that bodes well for the future, even as sales have stagnated in the first quarter, largely due to the slowdown in China (see graph). Revenue at LVMH’s jewelry and watch division fell 5% in the first three months of the year, while Richemont’s jewelry maisons declined 0.7%.

A sustainable rebound in Chinese demand will take some time, Rupert acknowledged, while assuring the group’s diverse client base across nationalities and geographies would support its activities moving forward.

Both Rupert and Arnault are taking a proactive approach, with a view to building on the many milestones their respective jewelry divisions marked.

Among those, in 2023, Tiffany & Co. reopened its flagship store, The Landmark, in New York. It also unveiled new collections, including the high-jewelry line Blue Book: Out of the Blue. Bulgari celebrated 75 years of Serpenti; Chaumet launched a new high-jewelry collection and held a retrospective exhibition, “A Golden Age: 1965-1985,” at its salon at 12 Place Vendôme; Buccellati marked 100 years of its Trinity collection and upgraded its Milan location; while Cartier opened its first store in Mumbai, India.

Both Richemont and LVMH are acutely aware they can’t take their positions for granted. As Arnault promised, LVMH will continue “with investments in production capacity and product quality; investments to raise awareness of our maisons and reinforce their prestige; [and] investments to boost our portfolio of standout properties and locations that underpin our brands’ commercial appeal.”

All that makes for a dynamic and creative segment of the jewelry market, as other brands are forced to make similar commitments and push their creative boundaries. Expect further innovation in 2024-25, as the fashion conglomerates continue to strengthen their positions — and influence — in the jewelry space.

Main image: A Bulgari Serpenti Viper jewelry piece featured in an illustration (David Polak/Midjourney/Elisé Jurkovic)