The diamond market has yet to feel the full effect of the war in Ukraine. Initial predictions pointed to a potential supply shortage that would result from having Alrosa, with its large share of global rough production, off the market. However, those scarcities have not emerged significantly.

This might be because the industry is still adjusting to the impact of US sanctions placed on Alrosa as the world will mark the one-year anniversary of Russia’s invasion of Ukraine on February 24. We recognize three areas in which the trade was, or will be, affected:

- A slowdown in demand as the war fuels global economic uncertainty;

- The decline in rough-diamond supply due to US sanctions on Alrosa;

- A bifurcation of the market as the industry splits into two streams, between ethically sourced diamonds and those that are not.

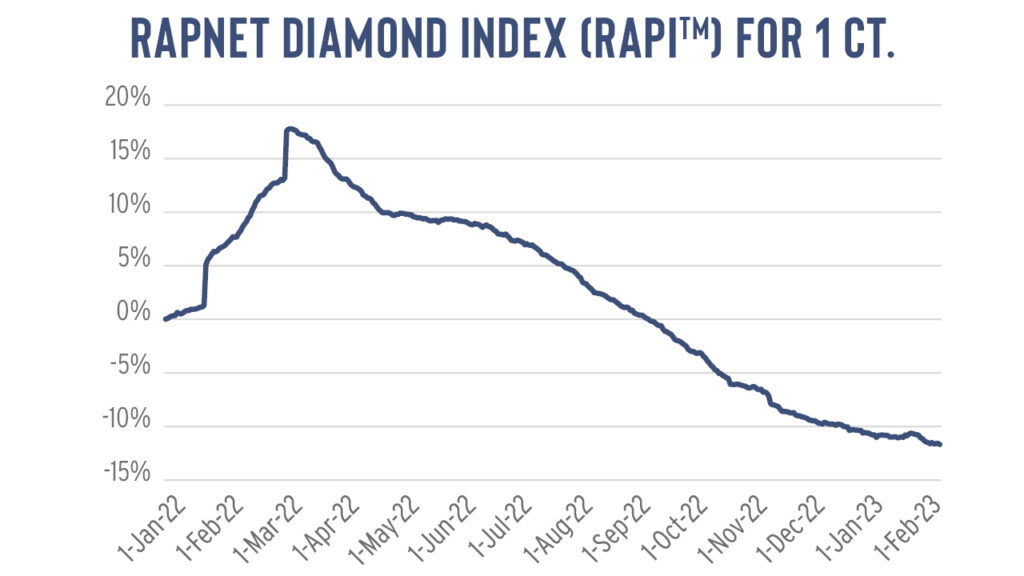

Among those factors, the industry most acutely felt the impact of the war on global demand in 2022. Trading slowed because of that event, along with the economic uncertainty already in play, with the conflict fueling high inflation. Polished prices peaked a week after the invasion and have been on a downtrend since (see graph below).

The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet®

The effect of the war on global economic growth is tapering off. The outlook for the US remains cautious due to continued inflation, higher interest rates and the inevitable drop-off from the strong recovery following the pandemic.

Meanwhile there is some optimism for a rebound in China since the government opened its borders after lifting its zero-Covid policy.

While that all plays out, the trade is now focusing on the second and third factors tied to Russia, which didn’t fully exert their influence in 2022. Those relate to how sanctions on Alrosa will affect supply and push the market toward showcasing its responsible-sourcing credentials.

This report is the first in a three-part series that Rapaport will publish about the diamond industry’s Russia crisis. In this installment we aim to understand Alrosa’s position in the market and the repercussions of the largest producer being excluded from the mainstream pipeline. Part two will focus on the sanctions and what they really mean for the industry. The third report will project what a split market might look like, outlining the industry’s options for tracing its supply and providing assurances to consumers that their diamonds are ethically and legally sourced.

A fox in a hole

Legend has it that a fox led geologists to the site where the first diamonds were found in Russia’s Yakutia Republic. More accurately, after recognizing a similar geological landscape to that of South Africa’s kimberlite ore formations, geologists in post-World War II Russia descended on Yakutia, a vast 1.2 million square-mile territory about 3,000 miles east of Moscow, scrutinizing the banks of the Vilyuy River for volcanic pipes. By the spring of 1955, geologist Yuri Khabardin was excited to come across a foxhole in a ravine that exposed blue earth, indicating high diamond content. (See “Alrosa the Diamond Fox” in the July 2013 issue of Rapaport Magazine).

Much was at stake, with the directive to find diamonds coming from the highest levels. Joseph Stalin recognized the need for industrial diamonds to help rebuild Russia after the war, and he knew he couldn’t rely on De Beers goods for fear they might boycott supply to the Soviet Union.

From that initial discovery of the Mir mine, Yakutia emerged as arguably the most diamondiferous region in the world. With its immense resource, the Russian government agreed to sell its production through De Beers, which enabled the then-South African miner to maintain its control of the diamond market.

While the volume of goods sold to De Beers varied over the years, the arrangement was terminated only in 2009 after the European Commission ruled the arrangement breached its competition laws.

That set Alrosa on a new path toward independence and influence in the diamond market. With an initial public offering (IPO) in sight, the company began offloading its noncore subsidiaries, which included oil, gas iron ore, hydropower, banking, aviation and hotel units. By the time of its listing in 2013, the company was focused on leveraging its rough-diamond production volume to spur growth.

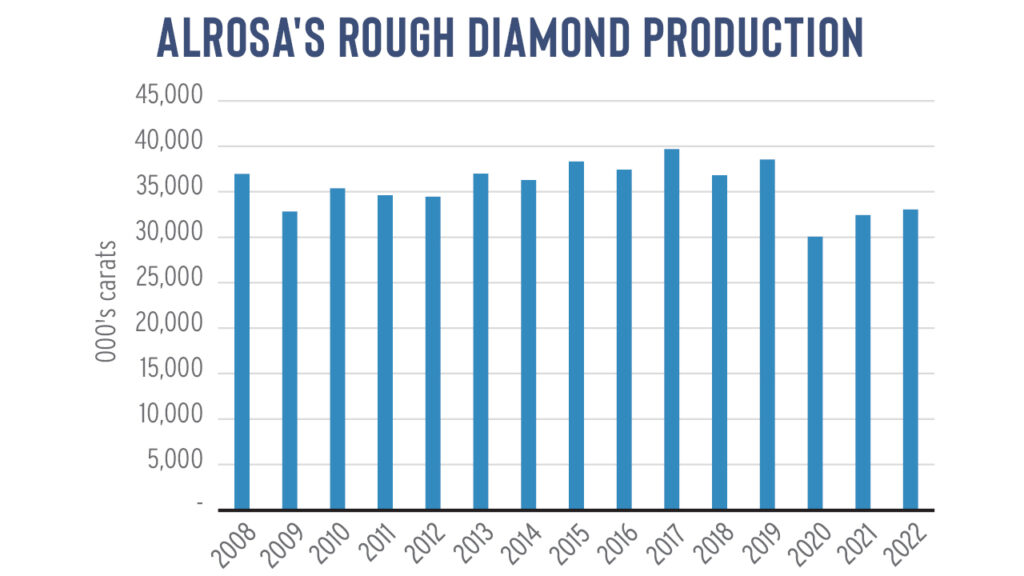

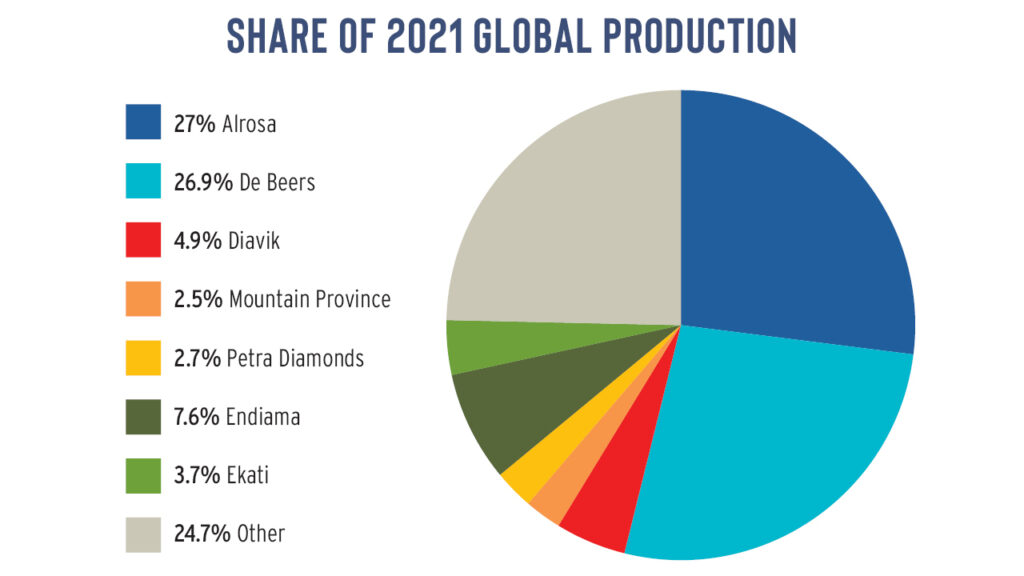

While De Beers had shifted focus to branding, Alrosa was building its credentials as the largest volume producer of rough diamonds. It recovered an average of around 35 million carats a year in the past decade (see graph), and although that dropped a bit in recent years, Alrosa was still the largest volume producer in 2021 — just above De Beers (see chart). Alrosa had projected production of 33 million to 34 million carats for 2022, though it hasn’t published its results since the onset of the war.

Based on Alrosa reports.Rapaport estimates based on company reports and global Kimberley Process data

The company has some 20 mines across five divisions, including Aikhal, Mirny, Udachny, Nyurba, and Lomonosov (Severalmaz) carrying an impressive resource of over 1 billion carats, according to its website. Those consist of a mix of kimberlite, alluvial and tailings operations, while Alrosa has invested heavily to go deeper with underground mining at the famed International, Aikhal and Udachny operations. A flood at the Mir underground mine in 2017 forced its closure, with reconstruction expected to begin in 2024.

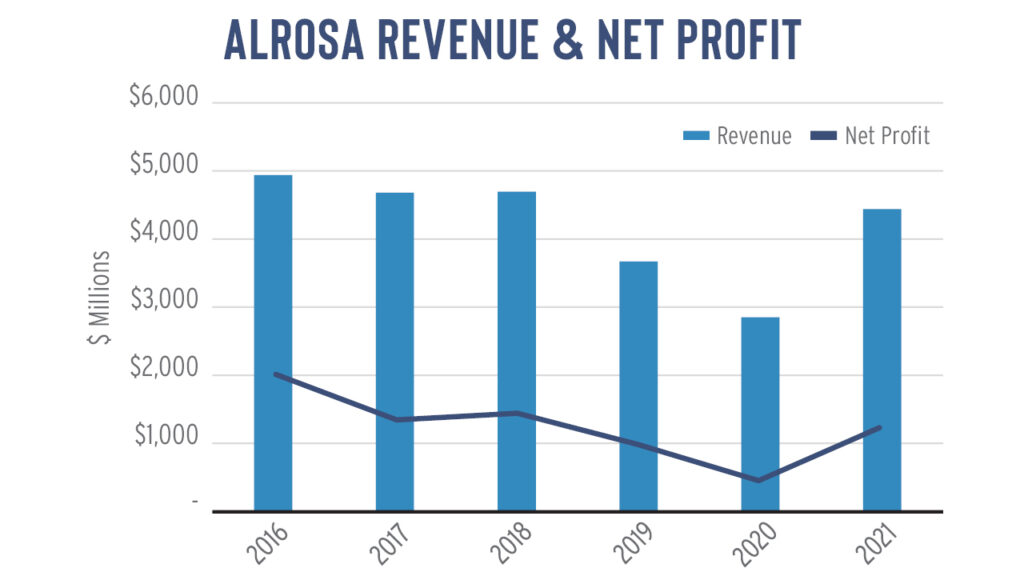

The company has enjoyed steady growth over the past decade. Revenue jumped 51% to RUB 326.97 billion ($2.99 billion) in 2021, spurred by the recovery from Covid-19, while net profit grew to RUB 91.32 billion ($834 million), almost triple 2020’s figure of RUB 32.25 billion ($297.3 million) (see graph).

Based on Alrosa reporting in Russian ruble. Converted to US dollars by Rapaport using the average USD-RUB

exchange rate for each year.

Correction, February 22, 2023: Belgium’s rough imports from Russia fell 53% by volume to 11.6 million carats in the first 10 months of 2022, and not 29% to 2.6 million carats as initially reported in this article. The combined imports of Russian rough to Belgium and India amounted to 15.7 million carats during the same period, down 44% by volume from the previous year, and not as stated previously.

This article first appeared in the February edition of the Rapaport Research Report. Subscribe here.