Traditional jewelry retailers, and diamond dealers for that matter, continue to express concern about the impact that online jewelers have had on the market. With complete price transparency and extensive information available on the web, brick and mortar stores today face a far more knowledgeable consumer than before, armed with strong price comparisons.

For online jewelers, most notably Blue Nile but also others such as ice.com, selling diamonds online offers a cost opportunity and margin potential that regular retailers can only envy. Still, few have effectively broken into the e-jeweler space and Blue Nile enjoys a significant share of the market.

Harvey Kanter, who was appointed Blue Nile’s new chief executive officer (CEO) in March 2012, estimates that the company is about three times larger than its nearest direct competitor. In fact, he insists that Blue Nile’s biggest challenge comes from brick and mortar stores, the Tiffany & Co., Zale and Sterling’s of the world that continue to garner strong customer loyalty.

To be clear, Kanter (pictured) stressed at the recent 2012 Citi Technology Conference, hosted by Citigroup Capital Markets, that the challenge doesn’t come from those jewelers’ online operations. “It’s difficult for them to compete online because they cannot lower their prices when they bring their merchandise online,” he explained.

Rather, Blue Nile recognizes that it needs to emulate the relationships they enjoy with their customers beyond the engagement purchase. As a result, Blue Nile is aiming to use its brand recognition to better penetrate the relatively untapped online non-engagement jewelry market, and with it, create its own band of loyal repeat customers.

“While non-engagement jewelry is the smaller part of the business for new customers, those customers are the bulk of repeat buying,” the company wrote in a recent investor presentation. “Building a much larger non-engagement jewelry business is key to building our franchise.”

In late 2011, shortly after Diane Irvine resigned as CEO, the company embarked on a three-pronged strategy to spur long-term growth. The strategy seeks to increase its value proposition for engagement jewelry customers, largely through improving its diamond sourcing efficiencies and passing that cost benefit onto its end-user prices. Secondly, as mentioned, the company aims to invest aggressively to acquire customers in its non-engagement jewelry business. And thirdly, it plans to expand its international activities, largely through its recent entry into mainland China.

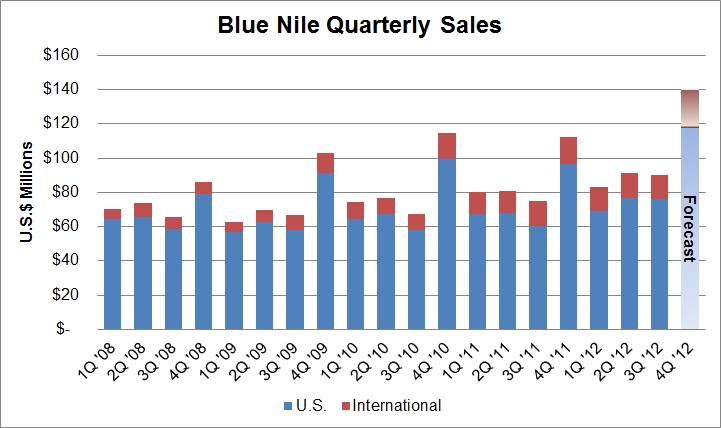

So far, the results have been mixed. Last week, Blue Nile reported that group sales rose an impressive 20 percent year on year to $89.8 million during the third quarter of 2012. Net income fell 7 percent to $1.7 million on higher expenses and cost of sales but earnings per share rose 8 percent to $0.14. Sales growth was spurred by its U.S. engagement jewelry segment increasing by 32 percent to $54.1 million, and the company’s U.S. non-engagement sales growing 12 percent to $21.8 million, while its international sales declined 3 percent to $13.9 million. Significantly, the number of new customers grew 22 percent during the quarter from a year earlier.

Investors have also offered mixed reactions to the strategy. The share hit its lowest point since March 2009 of $23.75 in August, but has recovered considerably to trade this week above $41 a share. Deutsche Bank reiterated its buy rating with a price target of $53.

Kanter expects the fourth quarter to provide greater validation of the strategy as the company has forecasted that sales will reach between $140 million and $153 million for the period, representing at least 25 percent growth from last year (see graph below). Following various segmentation and interface studies being carried out, Kanter expects the real breakout year for Blue Nile to be in 2014, which will be the first full year with all its programs in place.

Source: Rapaport News based on data published by Blue Nile.

Mostly, it is eyeing its non-engagement segment’s performance where it clearly sees the biggest growth opportunity, and the company has changed its assortments accordingly for the current fourth quarter.

The company is being careful to define its position as a specialty retailer. “We don’t want to become an Amazon for jewelry,” Kanter explains. “As a specialty store we have to have a defined point of view that a general merchant does not have. We are strongly focused around our design director and merchandising team developing a status for our point of view in the market place.”

The strategy encompasses expanding its assortment of goods, especially at lower price points below $1,000, and strengthening its conversion rate among female customers – women account for about 70 percent of traffic to the site but less than 30 percent of sales. Furthermore, relative to the overall jewelry industry, Blue Nile acknowledges it is under-indexed in categories such as gemstone, pearl, silver, gold and watches. At the same time, it is vigilant not to venture into costume jewelry, or runway and cutting edge fashion jewelry.

Still, the basis of the Blue Nile brand is its engagement jewelry business, and its model to enable consumers to buy loose diamonds and engaging them to buy rings to go with the stones. Kanter estimates that the company holds about 50 percent of the U.S. online engagement market and around 5 percent of the total U.S. engagement market.

Here, Blue Nile is taking a different approach to stimulate growth. Whereas non-engagement is all about accessing new customers, and building repeat purchases, its engagement proposition is ba sed on improving value through its diamond-sourcing strategy.

Already, the company said it was able to capitalize on the weak diamond pricing environment in 2012. Kanter points out that while competitors were sitting on inventory bought at peak 2011 prices for most of 2012, Blue Nile decided to invest in buying diamonds. The company has expanded its exclusive supply sources and raised the number of stones on the website to about 120,000 in the third quarter, from approximately 90,000 a year earlier. In June, Blue Nile claimed to hold one-quarter of the global supply of princess-cut stones.

Therefore, while the volume of its offering is expected to stabilize, Blue Nile remains an important buyer of diamonds, able to achieve margins where others cannot.

But the company faces some challenges along the road. For one, the diamond price environment will not always work in its favor. In its international business, China could prove difficult to penetrate and its timing may be a bit off as economic growth there has slowed.

The company is also prepared to increase its marketing spend to raise consumer confidence, not only in its brand and diamonds themselves, but in online purchasing. Diamonds and jewelry very much remain a touch and feel product which consumers still lack the confidence to buy online. They simply trust their jeweler far more.

Blue Nile may need to establish a small brick and mortar presence with a U.S. flagship store in order to enhance that trust, although Kanter insists no such plans are in the works. Blue Nile is therefore hoping to achieve greater trust through its stated strategy and is aiming to raise its brand profile to capture a larger portion of the mainstream jewelry market.

If it succeeds, Blue Nile could place additional price pressure on its more established brick and mortar competitors, not to mention its diamond suppliers. It may also become a strong bellwether of U.S. jewelry demand in the process.

As far as the internet goes, the diamond and jewelry industry is a relatively late bloomer, and somewhat of an enigma given the lack of competition in the retail virtual space. Either way, as others in the supply chain struggle to improve their margins, they might be eyeing Blue Nile with interest, wondering what additional effect online jewelers will have on their business in the future.